USD stablecoin USDT

The issuing company of U.Town USDT- is Tether, its parent company is iFinex, and iFinex also has another exchange "Bitfinex". USDT is the USD stable currency of the "fiat currency reserve", which is ۱ USDT There should be ۱ USD reserves behind it.

The legal currency reserve stablecoin is issued by a centralized institution. In the case of USDT, when Tether issues a stable currency, it must guarantee a one-to-one legal currency reserve behind it, and the user purchases it from a custodian institution or a third party. And according to this mechanism, ۱ USDT It should also be possible to exchange ۱ USD.

At present, USDT issued by Tether is the stable currency with the highest market share. According to CoinMarketCap data, Tether has issued a total of USDT of ۲۴۷ USDT, and USDC with the second market share is only ۱۹ billion dollars, the gap is huge, which is evident. It can be said that USDT is the basic settlement currency for encrypted transactions.

Due to the highest market share and the best liquidity, it can be seen that the most exchanges are USDT trading pairs, and most OTC (over-the-counter transactions) are also settled in USDT.

Where did the controversy come from?

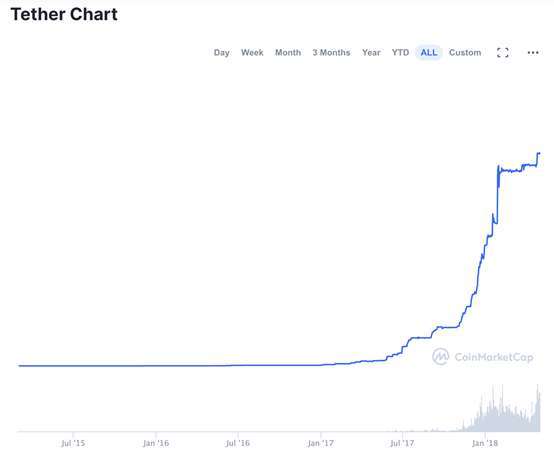

USDT- has been controversial for a long time, and the USDT issuance of Tether ushered in the first "explosive" growth in ۲۰۱۷ years. The circulation of ۲۰۱۷ year ۳ is only ۱ billion dollars, but in ۲۰۱۸ year ۲ By the end of the month, the USDT issuance had reached 200 million US dollars, so rumors about Tether "printing money to boost Bitcoin" were rampant.

However, this is actually a bit of a causal reversal, because the same situation can also be explained as the growth of cryptocurrencies, which has pushed up the demand for USDT.

After entering the bear market in ۲۰۱۸, the issuance of USDT has not slowed down, and by ۲۰۱۹, the issuance has reached ۴۰ billion US dollars. After entering the ۲۰۲۰ year, the demand is soaring. At the moment of writing, the USDT circulation is ۲۴۷ One hundred million U.S. dollars.

It is also reasonable for the community and investors to be concerned. In fact, Tether's "audit report" has never been able to prevent Yoyo's mouth.

Tether did publish an audit report in ۲۰۱۷ years, but it did not give the "source" and "access path" of the money, but a proof that Tether had so many assets.

Six months later, Tether released a statement about their banking issues and a new contract with Friedman LLP. Which clearly states that they are fully solvent. After Friedman LLP A memorandum was issued stating that the memorandum proved that Tether/Finex was solvent and did not commit wrongdoing.

However, these proofs are not accompanied by strong evidence, just to prove that Tether is solvent.

BITFINEX VS. NYAG

Next, is the moment when USDT faces the biggest doubt.

۲۰۱۹ In 2018, the New York Attorney General's Office (NYAG) sued Bitfinex, mainly because its sister company Tether account was short of about ۶٫۵ (the current amount was changed to ۸٫۵ billion), suspected Bitfinex misappropriated Tether reserves to make up for its lack of funds.

Why is there a shortage of funds?

At that time, the Bitfinex exchange was frozen by the government because of its appointed Panamanian payment processor "Crypto Capital", resulting in a huge funding gap for Bitfinex. Therefore, Bitfinex will report to the sister company. Tether "loans" ۸٫۵ billion dollars.

It is reported that the reason why Crypto Capital was frozen was because of the private misappropriation of Bitfinex funds. At that time, Reginald Fowler, who ran the shadow bank Crypto Capital, Fowler) opened accounts in multiple banks in the name of individuals and companies to covertly transfer funds from Bitfinex of about US$ ۸٫۵ (about NT$25 billion), even in ۲۰۱۹ years ۴ These illicit gains were used in May to fund the then-failed American Football League.

Strictly speaking, Bitfinex is also a victim.

However, this should not be used as an excuse to embezzle the ۸٫۵ billion reserve fund. Tether is the issuer of the US dollar stable currency USDT. The company advertises that it is 50% of US dollar reserves to convince the market.

But at that time, in order to help Bitfinex tide over the difficulties, Tether was even found to have quietly changed the terms of service that originally ۱۰۰% of reserves in USD to USD-anchored currency, Bitfinex parent company iFinex stock-backed loans, etc. as reserve assets.

To make matters worse, Tether admitted that the reserves of the stable currency USDT did not reach ۱۰۰% at that time, only about ۷۴% of the reserves.

However, in April last year, Tether stated that the reserve rate had returned to the level of ۱۰۰%.

The lawsuit between Bitfinex and NYAG is ongoing.

The progress at this stage is that Bitfinex and Tether have submitted the transaction documents of all users required by the NYAG, with more than 10,000 pages of documents, but because the amount of data is too large, it was originally scheduled for ۱month ۱۵ The review to be completed in 2019 will need to be extended for another ۳۰ days.

Can USDT be exchanged for USD?

From the above description, it can be found that USDT did have only ۷۴% reserves for a period of time from ۲۰۱۹ to ۲۰۲۰, but it has recovered to ۱۰۰% in ۲۰۲۰ year ۴, but it should be noted that Tether The terms have been changed from "۱۰۰% cash" to "۱۰۰ Asset endorsement".

Skeptics believe that Tether, as the issuer of USDT, the US dollar stablecoin with the highest market share, can completely "can" mint more USDT, thereby manipulating the price of Bitcoin or other encrypted markets, and some even claim that USDT cannot be exchanged for USD.

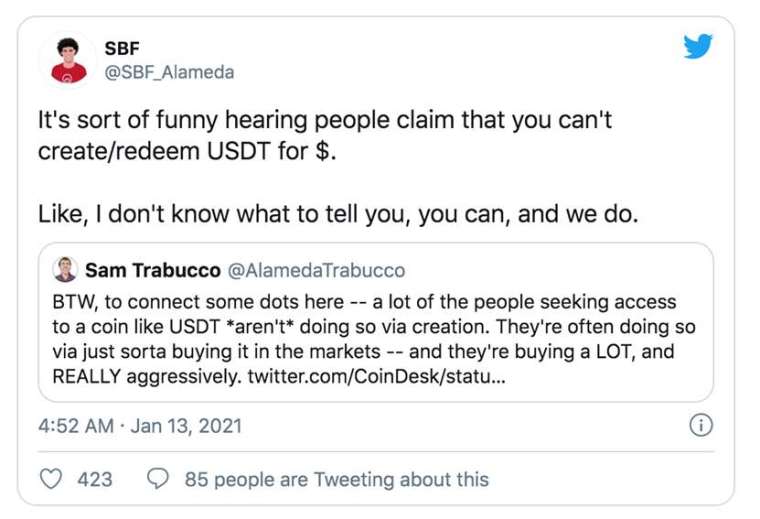

In this regard, Sam Bankman-Fried, founder and CEO of FTX, the world's fourth largest crypto exchange, believes that the idea of doubting whether USDT can be converted back into US dollars is a bit "funny".

Sam Bankman-Fried said:

“USDT can’t be exchanged for dollars, it sounds kind of funny. I don’t know how to explain it to you, but you can really exchange dollars back because we do it all the time.”

至As to why the audit report has not been released, The Block research director Larry Cermak believes that this may be related to the reason why Tether does not want to expose customers.

You know, the largest user of USDT is OTC in addition to cryptocurrency transactions. Due to the highest liquidity, many people use USDT as another means of foreign exchange. Users remit USDT to domestic / foreign countries, and then transfer USDT through Convert OTC to local fiat currency.

The blockchain media "Dynamic Zone" once reported that the daily OTC trading volume of cryptocurrencies in the over-the-counter trading cabinet (OTC) in Moscow is about ۳۰۰ million, of which about ۸۰% are stablecoins USDT. The report also pointed out that the USDT that Chinese companies buy every day ranges from ۱, ۰۰۰ million to as many as ۳, ۰۰۰ million.

Maya Shakhnazarova, Head of Huobi OTC Office in Moscow Said: "They (Chinese companies) have accumulated a lot of cash in Moscow and need to transfer them back to China; the whole process is very simple, customers come in with cash, we confirm the price on the exchange, and after the two sides agree on the price, the transaction is almost completed. The user gives us the money and wallet address, we put USDT is transferred to the designated wallet. "

This may be related to China's foreign exchange control. The Chinese government is very strict with capital control, limiting the amount of foreign currency that each person can buy or sell each year to ۵ 10,000 US dollars, even if you can apply for additional quota, but in general, the quota is still very limited. Under such circumstances, some people choose to use cryptocurrencies to transfer assets.

This is just one of those cases, there may actually be more. According to research by data research firm Chainalysis, China may be the main region for USDT purchases, especially since the Chinese government has banned Bitcoin, but not USDT, which is really suspicious. The driving force behind the surge in USDT issuance.

In conclusion

It is one thing to doubt whether USDT has ۱۰۰% asset endorsement, but if USDT cannot be exchanged for USD, then the first jumper will definitely be the exchange, because the most inflow/outflow of USDT is the exchange, and SBF's response It is also clearly explained that the exchange can exchange USD back to Tether.

At present, it seems that although the USDT controversy is still ongoing, there is no damage to the fact that USDT can be converted into US dollars, and the circulation is also the largest in the market. The major exchanges must also try their best to maintain the value of USDT.

U.Town will also continue to track and control the risk of USDT for users.